Budget 2016: What Will That Mean for SMEs?

Cuts To Tax & Business Rates For SMEs

George Osborne delivered a surprisingly upbeat budget that will finally give SMEs the attention that they deserve. In this year’s Budget, there are plans for cuts left, right and centre. Cuts to corporation tax, capitals gains tax and business rates.

However, there’s also a new tax in town, the sugar tax and not to mention the hike, once again, of insurance premium tax in order to fund the increased investment in flood defence.

With all the changes to come, how do you decipher what’s relevant to you and your business? Let’s take a closer look into some of the changes that are likely to affect you as an SME…

Targeting Obesity In The UK With Sugar Tax On Soft Drinks

The Chancellor announced the introduction of a new sugar tax levy on soft drinks. This is estimated to raise £520 million which will go towards longer school days and towards boosting sports in primary schools – essentially, targeting child obesity in the UK.

Read our previous blog post: Tax on Sugary Drinks Backed by MPs by clicking here.

A Fall In Corporation Tax For SMEs

It was also announced that corporation tax would fall to 19pc in 2017 and then to 18pc by 2020 – however, it’s fair to mention SME’s won’t see much benefit from this change once you take into consideration the increase in the national minimum wage to £7.20 and the fact that start-ups and small UK firms only generate marginal profits.

SMEs No Longer Have To Pay Business Rates

The chancellor ensured that 600,000 small businesses will no longer have to pay any business rates – ever. A big win for business owners and a true sign of his extended commitment to funding small businesses. The threshold business rates will be permanently raised from £6,000 to a maximum of £15,000 and from £18,000 to £51,000 for the higher rate.

Flexible Use Of Losses

Good news for SMEs – because of the way that many businesses now operate, for any losses incurred on or after April 1st, 2017, business owners will be able to carry forwards those losses against profits from other multiple streams of income and from other companies within a group.

Insurance Premium Tax Brings More Flood Maintenance

Many communities experienced the devastating impact of flooding this winter with homes and businesses destroyed. 2016 Budget announces an additional boost to spending on flood defence and resilience of over £700 million by 2020-21. The government plans to increase maintenance and deliver even more flood defence schemes in Leeds, York, Calder Valley, Carlisle and wider Cumbria.

The standard rate will rise by 0.5pc to 10pc which should take effect from 1st October 2016.

Capital Gains Tax Cut To Help Access Capital

The Chancellor also mentioned plans to cut Capital Gains Tax as the government’s way of taking action to boost enterprise by allowing companies to have more access to capital and, therefore, grow and aid in the creation of jobs.

From April 2016, the higher rate will fall from 28pc to 20pc and for the basic rate taxpayers, the rate will fall from 18pc to 10pc.

As for residential property and carried over interest, there will be an 8pc surcharge on these new rates as an incentive to invest in companies over property.

What Is In The 2016 Budget For Your SME?

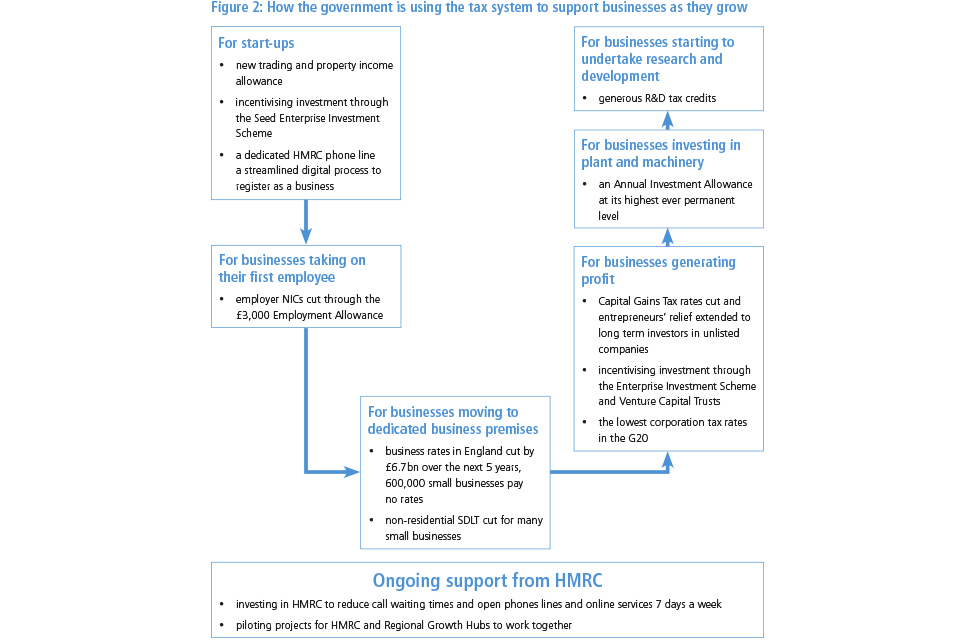

The diagram below shows the various ways that the government is using the tax system to support businesses as they grow.

(Image Source: Gov.uk)