What Financial Records Do I Need to Keep as a Business?

As a sole trader business, getting to know the ropes of financial accounting means knowing what to keep and for how long. In the UK, HMRC can request to see any record that you’ve reported to them, and thus you have to be able to provide sufficient evidence of a transaction. Else, there could be serious consequences.

Here are all the forms of financial records you need to have prepared in case the taxman does come looking for them.

Records of All Sales and Income

The first record a sole trader business needs to keep is a record of income. Any till rolls, sales invoices, bank statements or pay-in slips should be kept and preserved. In addition, accounts books should be kept even if you have run into another year or have finished the book.

Records of All Expenses

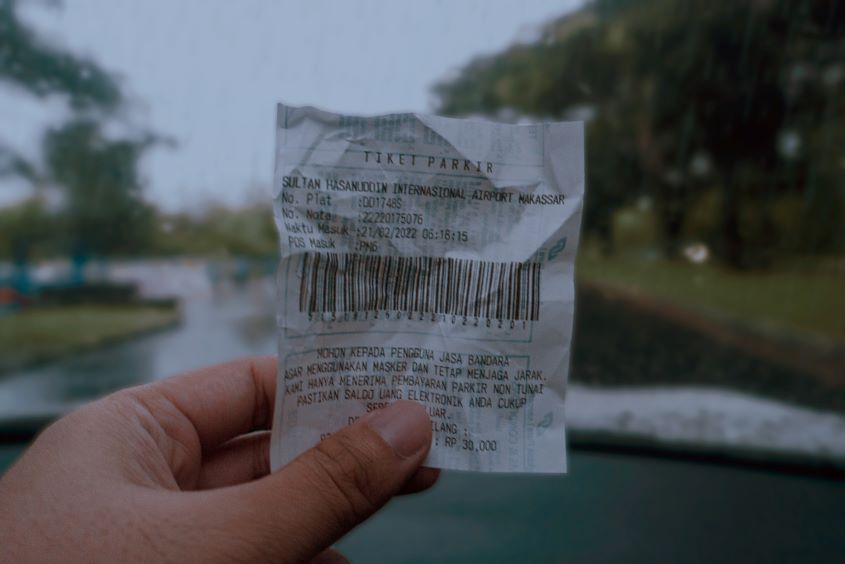

Every sole trader business should keep evidence of any expenses they make. This includes receipts for cash purchases, invoices, bank statements and chequebook stubs. If you have a corporate tax accountant, they will give you accounting records which they will keep for you. Additionally, any motoring expenses and mileage records should be logged, as well as any records of assets and liabilities, and any payments made to subcontractors should you have used them.

VAT Records

VAT records are another important form of financial record for any sole trader business to keep a hold of. This includes both originals and copies of all invoices issued, as well as self-billing agreements, contact details of any self-billing suppliers, import and export records and debit or credit notes.

This is the most thorough section of records, and even includes records of purchases that VAT cannot be reclaimed on, any stock given away or taken for private use and any VAT-exempt items bought or sold. Finally, a VAT account should be kept that is separate from the VAT your business charges and pays for on purchases.

PAYE Records

You should keep a record of all pay-as-you-earn (PAYE) records that impact employee payrolls. This includes payments made to employees, deductions from their salary for income tax and National Insurance contributions, details of employee benefits and expenses and statutory payment records for sick, maternity and paternity leave.

How Long Should a Business Keep These Records?

There are differing requirements on which types of records need to be kept in case the taxman requests it. However, to make organising easier, businesses keep all financial records for at least six years, at which point a statute of limitations-type rule prevents any records from being requested by HMRC.

Stonehouse Accountants Can Bookkeep For Your Business

Stonehouse is one of the leading sole trader and small business accounting services in Peterborough, and already has all the key information to navigating the many financial records you need to preserve. Our top-quality bookkeeping team will take care of keeping all the necessary records for you, preparing you for the end of the tax year without even having to double-check. Removing the worry and hassle of keeping everything in order means you can focus on running your business.

With over thirty years of leadership in the Peterborough area and beyond, Stonehouse Accountants is a surefire guarantee of a small business corporate tax accountancy team that will nurture your business’ finances to maximum effect. If you are interested in taking us on for your growing business, or have never used accounting services before and wondering more about what we do, contact our team today to get started.