Address

30 Thorpe Wood, Peterborough, Cambs, PE3 6SR

What is Bookkeeping? Bookkeeping is the process of recording and summarising financial transactions. It is an essential part of running any business, as it provides a way to track income and expenses, manage cash flow, and make informed financial decisions. Good bookkeeping can help businesses to: Stay on top of their finances Identify areas where […]

As a small business owner or sole trader, you know that there are a lot of administrative tasks that need to be taken care of on a regular basis. One of the most time-consuming and daunting tasks is account prep. What are annual accounts? Annual account preparation includes a set of financial statements that provide […]

As we roll into the second half of the year, business owners are right in the throes of the business annum. However, it’s also the perfect point to review your financial performance so far so you make any necessary adjustments to achieve year-end objectives and stick the landing come Christmas. As a small business owner, […]

As a sole trader in the UK, understanding the country’s tax system is essential for running a successful business. As a growing business, sorting and organising tax codes for your employees’ wage slips is no small feat. Through the PAYE (Pay As You Earn) system, businesses handle paying any income tax owed by their employees […]

When it comes to small business and sole trader bookkeeping, budgets can be tight and even small expenses can be a big blow to financial stability. This is why many businesses choose to have a petty cash system in the event of a surprise small expense. But what exactly is petty cash and how do […]

As a sole trader, preparing for year-end accounts and tax filing can be a daunting task. After all, how can you be sure that you have everything you need? However, with the right know-how and appropriate steps taken throughout the year to prepare, it transforms tax filings into a relatively straightforward process. If you’ve started […]

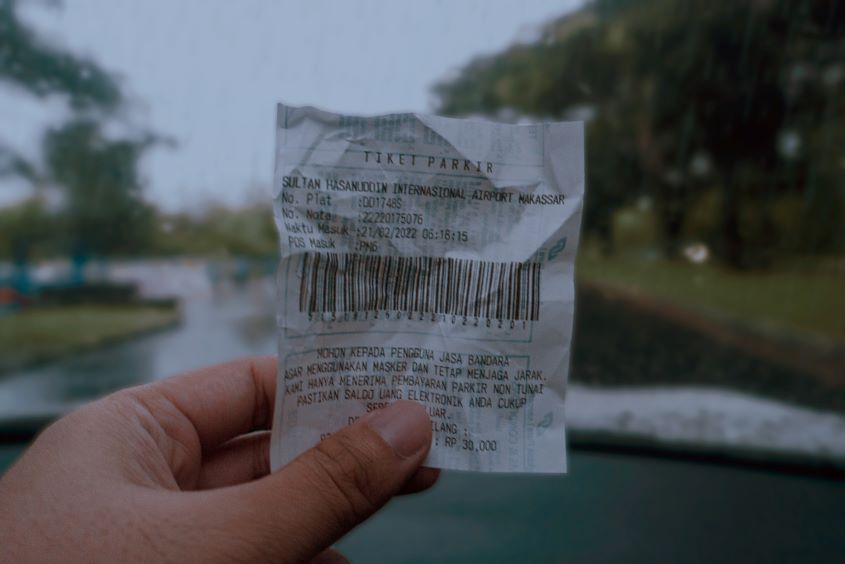

As a sole trader business, getting to know the ropes of financial accounting means knowing what to keep and for how long. In the UK, HMRC can request to see any record that you’ve reported to them, and thus you have to be able to provide sufficient evidence of a transaction. Else, there could be […]

For businesses, payday is one of the most important days of the month. It’s the time when your employees frantically refresh their banking app to check if their wages have gone through, making for a collective feel-good moment across your business. However, different businesses handle payroll with different schedules to benefit their business. They consider […]

For sole traders and small businesses, one of the most critical yet asinine tasks they are faced with is collecting unpaid invoices. You may find yourself offering credit to clients to get a sale over the line, but the hassle of chasing up unpaid invoices may leave you considering if all that is worth the […]

The most gratifying thing as a business owner is seeing your company, your pride and joy, attracting more customers and generating more profit. Perhaps you’ve been in a rut lately or have been keeping stable but with little growth, but that is where a small business accountant near you can help. Look around at financial […]